Embedded Finance Market Forecast, 2025-2032

Global Embedded Finance Market Size by Type of Financial Service (Payment Processing, Lending, Insurance, Investment, Banking Services), Deployment Model (Cloud-Based, On-Premises), End User Industry (E-commerce, Healthcare, Travel & Hospitality, Transportation, Retail), And Regional, Global Market Analysis and Forecast, 2025-2032

Report ID- 1014| Number of pages- 250

Report Industry- Financial Services | Published on- November 2024

Request Sample Buy NowMarket Overview:

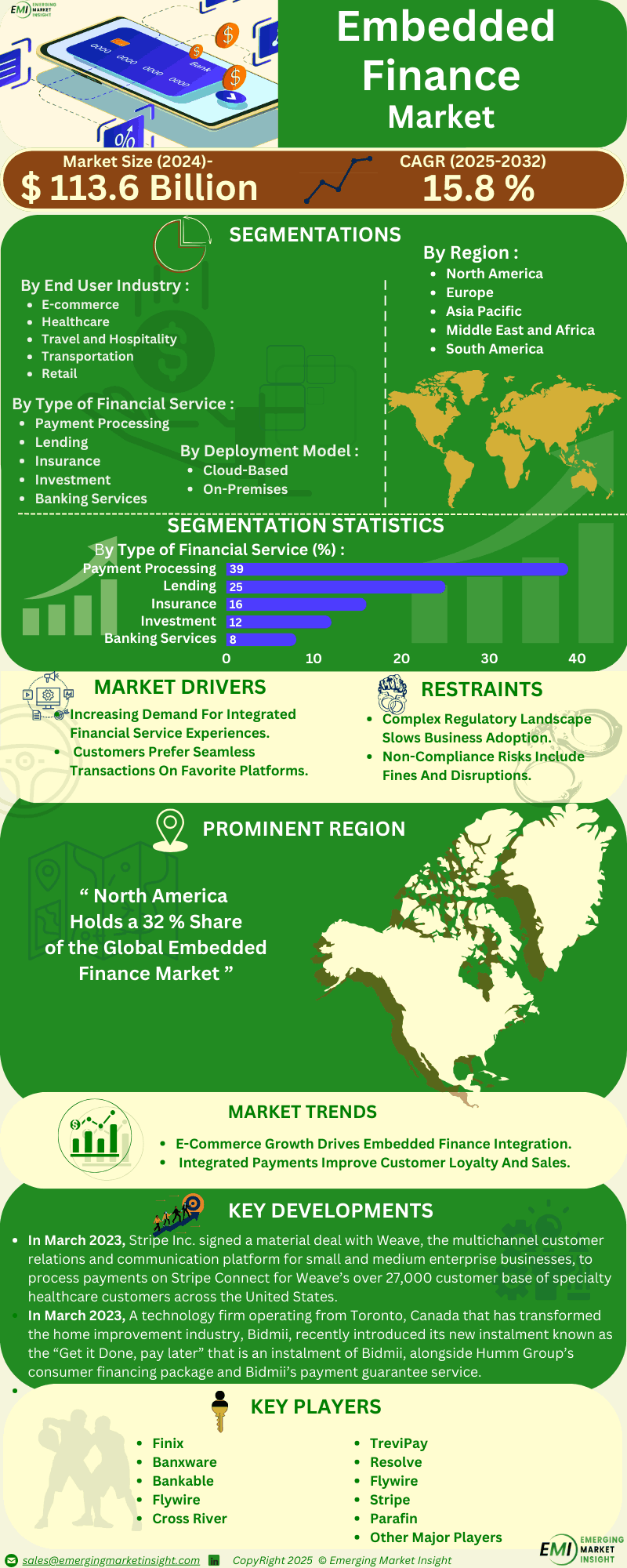

The Global Embedded Finance Market, valued at USD 113.6 billion in 2024, is forecasted to grow to USD 367.32 billion by 2032, with a steady CAGR of 15.8% from 2025-2032.

The embedded finance market involves offering finance solutions within non-financial networks, thus allowing firms to extend financial solutions without having to develop the institutional structures inherent in finance. This trend is being fueled by the growing need for the continuous cycle of sales by offering point solutions such as payment processing, lending, insurance, and investment services, all under one roof for better engagement and customer experience. The market is even expanding at a very robust pace due to the support of technology and regulations together for different types of sectors like e-commerce, healthcare, and transportation. Since customers today are inclined towards digital and seamless purchases, the market for embedded finance will grow exponentially, paving the way for opportunity for fintech firms as well as conventional financial organizations.

Market Dynamics:

Drivers:

Increased Demand for Seamless Experiences

The strengthening of the need for integration is one of the key factors defining the embedded finance market growth as customers expect inclusive transactions within environments preferred by them. This is because there is increasing pressure for efficiency and ease in interactions performed online. Customers are loyal to businesses that enable them to complete a financial transaction with that business – like payments, loans, or insurance – without having to leave their preferred platform. Thus, businesses’ incentives exist in integrating embedded finance solutions to improve satisfaction, decrease cart abandonment, and increase loyalty. Therefore, the integration of financial strategies into production diversifies the list of opportunities for delivering user-friendly products and services to customers whose expectations are changing fast.

Restraint:

Regulatory Challenges

One of the significant restraints on firms that are looking to include financial services on their platforms is that it involves a very complex landscape. For every region, the rules pertaining to financial transactions, consumer protection, and data privacy differ and change radically. This complexity demands a tremendous investment in terms of time and resources from businesses in order to maintain compliance and also generally requires legal input and continuous monitoring of regulatory changes. Non-adherence to these regulations faces severe penalties, damage to reputation, and operational disruptions. Thus, the regulatory burden slows down the adoption pace for many companies for this type of an embedded finance solution and limits market entry for numerous companies.

Opportunity:

Rising E-commerce Trends

The increasing rides in e-commerce has increased opportunities in the application of embedded finance to improve payment methods and customer credit. Given the constantly developing trend in the buying of goods through the internet, consumers are using easy and fast methods to reach a final agreement right in the systems they personally use most. Innovative solutions that are integrated, including payment gateways and immediate credit facilities, are likely to enhance the purchasing process since they introduce less resistance. Further, the solutions could be used by these firms to extend credit services to the consumers to facilitate the acquisition of more significant quantities and qualities, which they could not afford through regular purchase. Besides the sales promotion, this integration can increase the loyalty of consumers because they are satisfied with the one-stop shopping and efficient financial management within the electronic business platform.

Segmental Analysis of the Embedded Finance Market

By Type of Financial Service, payment processing Segment is expected to dominate the Market during the Forecast Period 2025-2032

Payment processing is one of the most significant and prevalent market segments of embedded finance solutions due to its core function of enabling transactions across various platforms. People’s reliance on online services, and especially purchases, has increased their need for swift and smooth payment systems that can be a part of experiences. Retailers are aware that the ability to handle all payments through one platform greatly diminishes the propensity for consumers to abandon their purchases midway through the process and improves the overall customer experience. Organizations benefit from mobile payments and secure payment gateways with contactless features to establish systematic implementations of these solutions. The embedded finance industry gains momentum because customers persistently increase their preference for rapid service each year without exception when it comes to payment processing.

Regional Analysis of the Embedded Finance Market:

North America is anticipated to lead the Global Embedded Finance market throughout the forecast period.

The North American region holds the largest share in the embedded finance market, mainly due to the strong technology ecosystem and high penetration of digital services among the population. A large number of start-ups and innovative technologies of fintech companies create competitive conditions and promote the development and implementation of embedded services. Additionally, advanced rules on digital technological support that regulate digital financial services defend the region, assuring businesses to advance new technologies. The customers’ desire and need for uninterrupted financial service experiences also drive the need for the convergence of financial services in multiple channels. The electronic business market in North America is progressively growing, thus, the market for embedded finance is expected to grow further, which secures its standing as a primary worldwide market.

Recent Development of the Global Embedded Finance Market:

- In March 2023, Stripe Inc. signed a material deal with Weave, the multichannel customer relations and communication platform for small and medium enterprise businesses, to process payments on Stripe Connect for Weave’s over 27,000 customer base of specialty healthcare customers across the United States.

- In March 2023, A technology firm operating from Toronto, Canada that has transformed the home improvement industry, Bidmii, recently introduced its new instalment known as the “Get it Done, Pay Later” that is an instalment of Bidmii, alongside Humm Group’s consumer financing package and Bidmii’s payment guarantee service.

Key Players in the Global Embedded Finance Market

· Finix

· Banxware

· Bankable

· Flywire

· Cross River

· TreviPay

· Resolve

· Flywire

· Stripe

· Parafin

· Other Major Players

Scope of the Report

By Type of Financial Service:

· Payment Processing

· Lending

· Insurance

· Investment

· Banking Services

By Deployment Model:

· Cloud-Based

· On-Premises

By End User Industry:

· E-commerce

· Healthcare

· Travel and Hospitality

· Transportation

· Retail

By Region

· North America (NA):

o United States

o Canada

o Mexico

· Europe (EU):

o Germany

o United Kingdom

o France

o Italy

o Spain

o Rest of Europe (including Netherlands, Sweden, Belgium, etc.)

· Asia-Pacific (APAC):

o China

o Japan

o India

o South Korea

o Australia

o Rest of Asia-Pacific (including Southeast Asia, New Zealand, etc.)

· Middle East & Africa (MEA):

o Saudi Arabia

o United Arab Emirates (UAE)

o South Africa

o Egypt

o Rest of Middle East & Africa (including Kuwait, Nigeria, etc.)

· South America (SA):

o Brazil

o Argentina

o Chile

o Rest of South America (including Colombia, Peru, etc.)

Frequently Asked Questions

Report Purchase options

Report Customization

- Dedicated Research on any specific segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2019 and forecast outlook till 2032.

- Flexibility of providing data/insights in various formats (PDF, PPT, Excel).

- Provide cross-segmentation in applicable scenarios/markets.